P&C Insurer Profits from PilotFish + Collaborative Partnership

Nearly all key operational processes in commercial property insurance still must be modernized, streamlined and enabled by automation and digitization. Straight-through processing needs to be pursued, especially in standard and customized small commercial lines of business. This P&C insurer brought in the right mix of software solutions to tackle faster quoting and underwriting, but even greater progress was achieved when the right professional services team and software engineering talent arrived.

Visionary IT leadership developed a highly collaborative partnership with PilotFish once the power of PilotFish’s integration technology was put into play. The teams shared the same mindset, values, integrity and laser focus on solutions. Time after time, the “right stuff” got done – quickly. Here’s how a partnership of IT leadership and PilotFish kept their eye on the prize to achieve steady profitable progress in modernizing the IT infrastructure at this P&C insurer.

THE CLIENT

The company is a US-based insurance carrier that offers commercial property and casualty insurance products. The portfolio addresses both standard and specialized insurance coverage, focusing on property and liability coverage for clients requiring underwriting. This includes underwriting policies with smaller commercial properties. A competitive advantage is the capability to underwrite insurance products for markets often underserved by other insurers.

THE CHALLENGE

The client’s digital transformation strategy aims to modernize, simplify, and streamline processes across every element of the insurance value chain— products, distribution, pricing and underwriting, policy issuance and service, claims, IT, and other support functions. The company also fully realized it had to address its accumulated “tech debt” by automating integrations and legacy systems fixes.

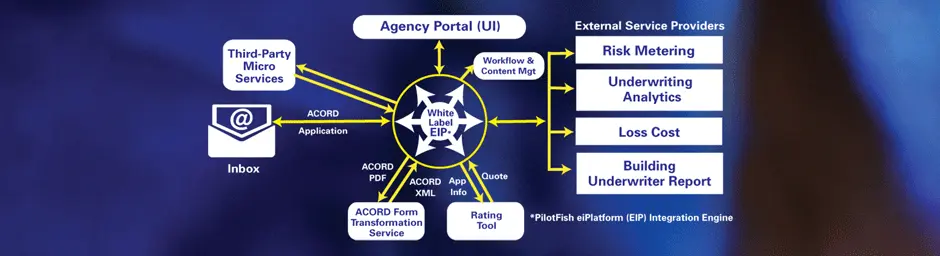

The client was implementing the last mile of a highly customized online-binding system. A policy administration vendor developed this new hosted system for a single line of the client’s commercial insurance offerings. This solution was in place and leveraged a white-labeled version of PilotFish to facilitate inbound processes of paper applications into the web-based agent underwriting portal.

At this point, there was no direct integration between the quoting system and the agent’s portal. PilotFish collaborated with the client’s team to automate the flow of information from the initial application to the quoting system. This automation was initially targeted at limited classes of insureds but now continues to be expanded to cover a growing percentage of applications.

However, the client had an aggressive and more ambitious vision that had not yet been fully realized and looked to augment a small but capable in-house team to make it happen.

THE SOLUTION

In need of additional skilled resources familiar with the underpinnings of their implementation, the client turned to the PilotFish professional services team. The vendor of the agent portal software at the heart of the implementation made this introduction. As a long-time partner of PilotFish, they were deeply familiar with not only the PilotFish software – which they distribute as the middleware component of their product suite – but with the strength of the PilotFish professional services team.

PilotFish, the vendor partner and the client met for a series of short but intensive knowledge transfer and strategy sessions in the ramp-up process. The client reinforced their team with several new members from PilotFish. Deeply experienced in insurance integration as well as the surrounding technologies, the PilotFish team melded seamlessly with the institutional knowledge, vision and leadership of the client’s team. The result was a cohesive unit capable of efficiently and consistently producing business value through technology solutions.

The team has delivered on the aggressive goals of the business, one of which has been to continuously reduce the manual effort and turnaround time involved with processing an application. The applications are ACORD-based forms for new business. They arrive as attachments to a standard email.

PilotFish software facilitates the receipt and identification of the applications as well as orchestrates their entry into an internal agent-facing portal.

- The process begins with the submission of the PDF application to a cloud-based third-party OCR application. This application scans and converts the applications into ACORD-like, machine-readable XML.

- Business rules are applied to cleanse, index and classify the applications.

- Then based on the content of the application, PilotFish automatically orchestrates outbound calls to a variety of services (internal and external), providing evidentiary reports critical to the underwriting process.

- Once all relevant data is gathered, PilotFish prepares, transforms and transmits the required data to the internal quoting and binding application.

- As reports are received, they are also cataloged in the client’s imaging system and made available for review with a single click at the agent/underwriting portal.

THE BENEFITS

PilotFish’s best-of-breed insurance integration software is built with the sole purpose of facilitating the interoperability of systems, trading partners, and data regardless of source, technology platform, standards compliance, communications protocols or data formats. As a hosted software solution, PilotFish offered the benefits of no onsite installation or new hardware for the company or its agents; no extra screens or workflows; no user interface complexity at all.

The PilotFish team delivered deep expertise in developing Enterprise Integration solutions for clients in the insurance industry. The client leveraged the experience of PilotFish’s Strategic Technology Consultant as well as embedded a PilotFish senior lead software engineer full time. The senior lead software engineer brought sought-after experience in developing web apps used by insurers to submit policies, receive quotes, run reports provided by external web services and more.

The collaboration team held no-nonsense virtual meetings every other day for no more than half an hour, with extended working sessions scheduled separately as needed. They had the advantage of being a small team with direct communication lines. As soon as a problem arose, the team came up with a solution. They employed it, tweaked it, got results and moved forward.

As the client’s team began to see and understand more and more what PilotFish could do and solve, they turned increasingly to Pilotfish’s embedded senior lead to see if PilotFish could solve a problem or offer a creative solution.

Within just nine months of PilotFish’s engagement, the time to turn around a quote was dramatically slashed and integration processes automated, simplified and streamlined. A clear business impact was significantly less human touch at every stage of the application. Financial benefits began to be accrued from accelerating the quote system, which resulted in more quickly realized new business. The system started in one state and is now in ten states and will soon roll out nationwide.

With PilotFish middleware, insurers gain the business advantages of a single, consistent approach to integrations through:

- Greater automation and streamlined business processes.

- Easy electronic exchange between internal systems as well as with external data and information services widely used in the insurance industry.

- No problem with syntactic interoperability, semantic interoperability and workflow interoperability.

- Reuse of default templates and pre-built insurance industry templates that result in lower costs of both ongoing maintenance and integrating new standards or technologies.

If the PilotFish partnership with the IT team had a mantra, it could be summed up as:

- If it works, do more of it. If it doesn’t, do something different. Exploit successes.

- Don’t accept that you have to wait on someone or something that impedes progress.

- Hold yourself exceptionally accountable for delivering for the client.

- Collaboration and flexibility accelerate and enhance change.

THE FUTURE

Today’s P&C marketplace requires that carriers be faster, more agile and more creative than at any time before. As a result, they need insurance core systems designed to implement change quickly and easily and work elegantly with one another.

New capabilities unleashed by PilotFish’s collaboration with the IT team became a jumping-off point to take advantage of innovations and quickly integrate them into core systems and business processes. For example, the business unit created microservices and a robust set of APIs to share with other internal groups that are now in place to advance the entire enterprise.

The company has leveraged PilotFish experts in integrating systems, application and software development, system maintenance programming, object and system design, prototype development, software implementation and project planning/ management.

The client’s confidence grew in the partnership with PilotFish as the extraordinary collaboration helped their architecture evolve as a platform. They continue to look at ways to push the barriers jointly with PilotFish to further facilitate and grow the new business underwriting process. The joint team’s healthy relationships, built on trust, open communication, shared values and mutual respect, opened new avenues for applying their collaborative approach to what seemed to be intractable or huge challenges at the company.

While every client engagement is unique, PilotFish has replicated trusted partnerships that create great value and delivered remarkable results for clients anchored in the sophistication and power of our software and the talent of our professional services.

Since its founding in 2001, PilotFish has been solely focused on the development of software products that enable the integration of systems, applications, equipment and devices. Billions of bits of data transverse through PilotFish software connecting virtually every kind of entity in healthcare, 90% of the top insurers, financial service companies, a wide range of manufacturers, as well as governments and their agencies. PilotFish distributes Product Licenses and delivers services directly to end users, solution providers and Value-Added Resellers across multiple industries to address a broad spectrum of integration requirements.

PilotFish will reduce your upfront investment, deliver more value and generate a higher ROI. Give us a call at 860 632 9900 or click the button.